Overview of Recent Legal Ruling

The recent ruling by a federal judge has sent shockwaves through the student borrower community, emphasizing the fraught intersection of politics and education policy in America. With millions of Americans caught in a web of debt, this decision not only blocks further cancellation efforts but highlights a growing concern over judicial authority in shaping economic futures. Borrowers who were counting on relief are left grappling with uncertainty, as legal battles may prolong their financial burdens.

This ruling underscores an urgent question: what does justice look like when weighed against political ideologies? The tension between judicial interpretation and executive action reveals stark disparities in how policy translates into real-life consequences for individuals. As advocates for student debt relief scramble to regroup and assess next steps, it’s clear that the conversation around educational financing is far from over. The implications of this decision reach beyond immediate effects; they invite broader discussions about accountability in governance and the evolving nature of educational access amidst shifting power dynamics.

Background: Context of Student Debt Cancellation

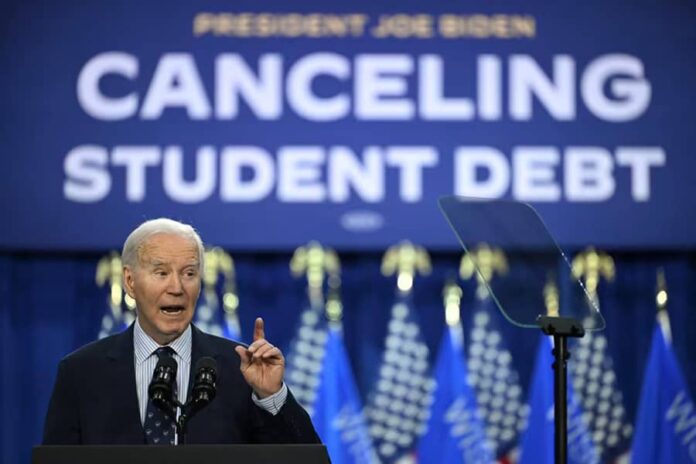

The recent ruling against President Biden’s plans for broad student debt cancellation reflects a complex interplay of political power, economic disparity, and public sentiment toward education funding. For millions of Americans, the burden of student loans has shaped their life choices—delaying home ownership, family planning, or career aspirations. This judicial roadblock not only halts immediate relief for nearly 30 million borrowers but also resurrects a fraught debate about the role of government in higher education financing.

Moreover, the backdrop to this ruling is steeped in rising tuition costs that have outpaced inflation and wage growth for decades. The notion that a college degree equates to financial stability feels increasingly outdated as graduates grapple with mounting debt while navigating an unpredictable job market post-pandemic. This decision may change the trajectory of future policies surrounding education reform by re-igniting calls for comprehensive systemic changes rather than piecemeal solutions that fail to address root causes. As advocates on both sides mobilize their efforts, one thing remains clear: the conversation around student debt is far from over; it’s merely evolved into its next chapter.

Judge’s Appointment: Trump’s Influence on Judiciary

The appointment of judges by former President Donald Trump has left an indelible mark on the American judiciary, steering it toward a more conservative ideology that continues to impact crucial policy areas. With nearly 230 federal judges confirmed during his tenure, Trump’s influence is palpable in landmark rulings like the recent decision halting broader student debt cancellation. This particular ruling not only underscores the shifting judicial landscape but also highlights how the judiciary can act as a battleground for polarizing political issues, often overshadowing legislative efforts.

As we witness this unfolding drama, it’s essential to consider what a politicized judiciary means for future administrations and their ambitious policy goals. The implications extend beyond just student loans; they threaten nations’ efforts in education reform, economic equity, and social justice. This situation raises critical questions about the balance of power within government institutions and whether judicial appointments should be less about partisan advantage and more about impartiality and fairness—values fundamental to a functioning democracy. In a divided nation, such reflections are vital as they remind us that today’s judicial decisions can reverberate across generations.

Case Details: What Led to the Ruling

The ruling stemmed from a complex interplay of legal arguments surrounding the Biden administration’s plan to implement a broad student debt cancellation program. Opponents, led by Republican officials and advocacy groups, contended that the initiative overstepped executive authority, arguing it violated the Administrative Procedure Act by failing to go through proper notice-and-comment rulemaking. They painted the case as one of accountability and transparency, suggesting that such sweeping changes should not be made without direct input from taxpayers and stakeholders—essentially framing it as a protection against an expansive federal reach into personal finance.

Moreover, this decision reflects broader societal tensions concerning education financing and economic equity. The rhetoric surrounding the case underscores deep divides: while proponents see debt relief as a necessary lifeline for struggling borrowers seeking opportunities for advancement, critics view such measures as an inequitable handout that unfairly burdens those who either paid off their loans or opted against higher education altogether. This ruling thus not only stymies immediate relief efforts but also catalyzes ongoing debates about America’s approach to higher education costs—a conversation likely to shape policy decisions well beyond this particular administrational clash.

Impact on Borrowers: Who Will Be Affected?

For millions of borrowers, the recent judicial ruling represents more than just a legal setback; it signifies a deeper wave of uncertainty that threatens financial futures. Those counting on debt cancellation are now grappling with the stark reality that their relief is once again in limbo. Graduates starting their careers amid rising costs of living and inflation may find themselves ensnared in an even tighter financial squeeze, impacting major life decisions such as home purchases or family planning.

Moreover, this decision disproportionately affects those from marginalized communities who already face systemic barriers to wealth accumulation. Many had hoped that widespread forgiveness would act as a catalyst for economic mobility—a chance to break cycles of poverty that have long held back entire generations. As hopes fade, lenders and servicers may also experience upheaval; some will be forced to recalibrate their expectations for repayment timelines while borrowers reassess their financial strategies. The ripple effects extend beyond student loans, touching everything from consumer spending patterns to overall economic growth, underscoring how interconnected our financial systems truly are.

Government Response: Biden Administration’s Next Steps

In the wake of this unexpected legal roadblock, the Biden administration is poised to rethink its strategy on student debt relief. Rather than seeing this setback as a defeat, officials may choose to pivot towards targeted solutions that resonate more closely with key demographics among borrowers. This approach could involve leveraging existing frameworks such as income-driven repayment plans or expanding eligibility for public service loan forgiveness programs. By honing in on these alternatives, the administration might cultivate public support while demonstrating a commitment to alleviating student debt burdens.

Moreover, policymakers are likely considering legislative avenues—perhaps collaborating with Congress to pass new measures aimed at robust reform of federal loan systems. Given that public sentiment is strongly in favor of addressing soaring education costs, there’s potential for bipartisan discussions around meaningful changes that extend beyond mere cancelation efforts. If successfully navigated, such efforts could not only mitigate the immediate impact of judicial limitations but also lay the groundwork for sustainable financial relief going forward for millions still grappling with their student loans.

Political Reactions: Democrats vs. Republicans Standpoints

In the wake of the federal judge’s ruling, a clear divide has deepened between Democrats and Republicans regarding student debt relief. For Democrats, this setback is not merely a legal hurdle but a profound blow to their promise of alleviating financial burdens for millions. Many party members argue that systemic reform in higher education financing was long overdue, making this ruling feel like an abandonment of both social equity and economic justice. They contend that supporting those in debt is not just about individual cases; it’s about uplifting entire communities and investing in future generations’ potential.

Conversely, Republicans have seized upon this event to bolster their foundational belief in personal responsibility and limited government intervention. They frame the judicial decision as a necessary check on what they describe as overreach by the Biden administration, arguing that blanket forgiveness undermines fiscal discipline and pushes taxpayers to foot the bill for others’ decisions. This rallying point taps into broader concerns over federal spending priorities, inviting voters who are wary of extensive welfare programs to engage with Republican narratives advocating for market-driven solutions instead. As discussions unfold in the political landscape, how each party navigates its base’s sentiments on educational access will shape upcoming electoral strategies significantly.

Future Implications: Long-Term Effects on Policy

The ruling against broader student debt cancellation highlights deeper implications for future policy-making, particularly in the realm of financial reform and higher education. As judicial barriers are erected, lawmakers may be compelled to reevaluate not just the mechanisms for debt relief but the entire framework of student financing. This could catalyze significant discussions around the necessity of comprehensive reform to address soaring tuition costs and prevent future borrowers from becoming ensnared in debilitating debt.

In a landscape marked by increasing polarization around fiscal responsibility versus educational accessibility, policymakers will face mounting pressure to propose solutions that transcend partisan divides. Innovative alternatives such as income-driven repayment plans or adjustments to federal grants might emerge as favored strategies. Moreover, this ruling could serve as a rallying point for advocacy groups pushing for radical changes in how education is funded, perhaps sparking renewed calls for universal tuition-free college options that address systemic inequities head-on. Ultimately, this legal battle provides a crucial lens through which we can assess not only our current policies but also envision an equitable pathway forward—one that prioritizes educational empowerment over debt servitude.

Alternatives for Borrowers: Other Relief Options Available

While the recent ruling has momentarily stifled hopes for broader student debt cancellation, borrowers still have a variety of relief options at their disposal. Programs such as Income-Driven Repayment (IDR) plans allow borrowers to tailor their monthly payments based on their income, effectively making repayment more manageable. With forgiveness potential after 20 to 25 years of consistent payments, this can be a path toward eventual financial freedom for many.

Moreover, loan forgiveness programs tied to public service or nonprofit work remain robust avenues for those seeking relief. The Public Service Loan Forgiveness (PSLF) initiative offers complete loan discharge after just ten years of qualifying employment—a critical lifeline for educators, healthcare workers, and others committed to serving their communities. Additionally, exploring state-specific initiatives or employer assistance programs could unveil further support mechanisms tailored to individual circumstances.

Finally, it’s crucial for borrowers to stay informed about legislative developments and advocacy efforts aimed at reforming the student loan landscape. Grassroots movements pushing for debt reform not only raise awareness but may also influence future policy changes that benefit millions caught in the tidal wave of student loans. Engaging with these groups could offer not just immediate relief solutions but also empower individuals through knowledge and community action in the long run.

Summary and Call to Action

The recent ruling by a federal judge underscores the ongoing tension surrounding student debt relief in America, revealing not just legal battles but also the personal stakes for millions of borrowers. As 30 million individuals grapple with the uncertainty of their financial futures, this setback serves as a stark reminder of how fragile progress can be in the realm of educational reform. Each day without action compounds their burden, highlighting the urgent need for policy solutions that transcend partisan lines.

Now is the time for advocacy and collective voices to resonate louder than ever. Whether you’re among those affected or simply believe in equitable education access, engaging with local representatives and sharing your story can create ripple effects that reach far beyond one courtroom decision. Join discussions, support organizations dedicated to student debt reform, and take action—sign petitions or attend town hall meetings—to compel government officials to prioritize sustainable solutions that ensure higher education doesn’t come at an unmanageable cost. Together, we can turn disappointment into momentum on this crucial issue affecting our society’s future.